Are you If not, could you forward this site to this person? |

|

|

infomore |

in order to visit thishousewillexist.org |

|

|

|

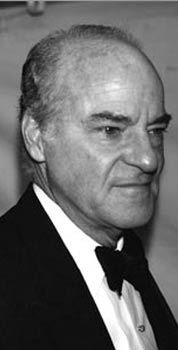

Henry Kravis is a legend of finance, the king of leveraged buyouts (LBOs, corporate buyouts financed by loans repaid by the acquired company). It is mostly the boss of the investment fund KKR (it is one of the K). With his partners, he popularized the bootstrap acquisitions, which include purchase of undervalued companies with the help of the management team. Remains only to reinvigorate, even if cut or drastically reduce costs, before selling to the key with a comfortable surplus value.

But these achievements are not necessarily made for times of crisis. KKR suffers: its IPO keeps hearth delayed. In October, Henry Kravis was reassured by the banking sector, which he stabilized. That was before the new call for help from Citigroup ... Concerned about the "lack of confidence in the value of financial assets," he explained not see "any evidence that this trend would be reversed quickly."

------

Site for Robert R. Kravis

------

Henry R Kravis, the king of the LBO

Henry R Kravis is unquestionably a monument history of American finance. In 1988, he made the takeover of RJR Nabisco for $ 25 billion.

Heny R Kravis was born January 6, 1944 in Tulsa, Oklahoma State. The young Henry lived in the eastern United States, then moved to California where he studied at the University of Claremont. Attracted by finance, following an MBA in 1969 at Columbia University, he joined the investment bank Bear Stearns at the same time one of his cousins, George R Roberts. Both worked under Jerome Kohlberg Jr. in charge of corporate finance.

Kohlberg taught the art of acquisitions, "Bootstrap". He looks for undervalued companies small or large groups of entities with the same problem, then helps the management team to buy the company. This new market is promising that Kohlberg believes looked up internally.

------

Site for Robert R.

------

In 1976, the refusal of Bear Stearns to finance some of its projects, Kohlberg resigned and left with his two young colleagues. Together they created an investment firm that became one of the most famous U.S. Kohlberg Kravis Roberts & Co. better known by the acronym of KKR.

Over the next six years, Henry Kravis creates a series of partnerships to buy companies, restructure (layoffs, cost reduction etc.), assign some non-performing assets or subsidiaries before selling the company at a price higher that to which it was bought ... Generally, KKR used in the buyback its equity to 10% of the purchase price and borrowed the rest, including the issuing of the famous "Junk Bonds" specialty investment bank Drexel Burnham and Michael Milken, the star of finance in the 80s.

AJIndustries, Lily-Tulip, and Houdaille Industries were some of the Leveraged Buy Out of the late 70s and early 80s realized that KKR. Houdaille was the first major company to be listed on the New York to be acquired by LBO. During these years, income from KKR were around $ 50 million per year.

------

for Robert R. Kravis

------

In 1984, KKR LBO made his first of over a billion dollars. It was the redemption of society Wometco. KKR took the company Amstar, for 450 million dollars before selling it for $ 700 million in 1986. When another influential figure in the world of finance these years, T. Boone Pickens, tried to resume the oil company Gulf Oil, KKR plays the role of white knight came to the rescue of the company contested, against making a bid 12 billion dollars but was surpassed by Chevron.

In 1987, Jerome Kohlberg resigned from KKR and Henry Kravis succeeded him as senior partner.

In 1988, under the direction of Kravis and after a Homeric battle five weeks, KKR gained control of RJR Nabisco (tobacco giant and the food at the time the 19th American company) for $ 25 billion, almost double the previous world record for the purchase of a business.

The deal was financed by bank debt through the issue of Junk Bonds, and an equity investment of $ 3.6 billion by KKR. The publicity around what was then the largest financial deal in history even gave rise to several films and turned instantly Henry Kravis and his cousin George Roberts stars goes beyond the inner circle of the world of finance.

Since its founding KKR has completed buyback operations for more than $ 73 billion on 45 companies. Among the companies purchased or sold by Kravis and his associates can find names such as Texaco, Gillette, Playtex, Samsonite etc. .. Henry Kravis is now a member of the board of directors of numerous companies (American-Re, Duracell, UnionTexasPetroleum. ..)

In recent years, the balance of his firm has been more mixed, with some operations prove successful, while others ended with losses. The firm is still closely controlled by Kravis and Roberts, and opened a London office. However, she lost many of its partners, including many who made his reputation in the 80s.

------

Site for Robert R. Kravis

------