Are you If not, could you forward this site to this person? |

|

|

infomore |

I have done this site especially for Marguerite Harbert Gray |

|

|

|

Sorry for my poor english translation.

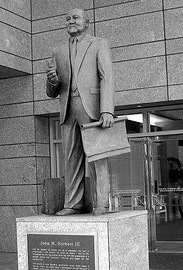

Harbert Management Corporation, based in Birmingham, Alabama, is a U.S. investment management company founded in 1993 by Raymond J. Harbert.

The company has investment funds in 12 alternative asset classes in three areas of concentration: real estate, private capital, and absolute return strategies.

------

Developer

The developer is a vendor spaces built or constructed.

Nowadays, it is he who initiates the process of new supply in real estate. His expertise, knowledge of opportunities on the demand side and its control of the primary resource, land, make the major agent of the property market, one that mediates between the other players have (especially users of space, financial and regulatory authorities).

---

-> Created for Marguerite Harbert Gray

Origin of the term

The term "real estate" was coined in 1954 in the entourage of Fernand Pouillon to denote previously known as the "editors of real estate." The intense housing supported by the then French government and real estate speculation which accompanied it consecrated the character and the term.

According to Robert Historically, the term "promoter" has come in the middle of the twentieth century to refer specifically to the developer, "a person who provides financing and construction of buildings." The terms "real estate" and "property development" are equivalent but "developer" is a anglicism.

----

-> Created for Marguerite Harbert Gray

Types of promoters

There is no terminological distinction in French between land developer (land developer) and developer (building developer). The two activities often coexist in the same company. However, we can distinguish them for methodological purposes.

The land developer, typical of peripheral areas of cities, generally acquires vast wasteland and subdivided through the subdivision, then improves by installing the necessary infrastructure construction: street, water, sewer, etc.. He also runs occasionally to obtain local zoning changes that may be required. When the developer then sells the parcels of land serviced and ready to build, for an immediate profit rather than long term, it can be regarded as property developer.

The developer acquires vacant land, land improvement (or served or serviced) or any other property that requires redevelopment built and he built one or more buildings in order to sell (bulk or divided into parts) or lease.

Most developers are small businesses run by former lawyers or realtors. They have relatively few employees and little equity, but they have the ability to find the necessary funding from lending institutions. The financing facility, and thus starting a new project, depends on the condition of the property market of the moment in the category of projected space and the financial strength of potential tenants that the developer has unearthed. The proponent must demonstrate a level of pre-lease by lenders considered sufficient for the building type and market in order to minimize the risk of new development.

Some developers have their own architectural services, construction and property management, but most give the contract work.

-> Site for Marguerite Harbert Gray

The formation of the promoter

In North America, although some academic programs emphasize real estate development (typically MBA programs) and if some universities offer a master's degree in specific real estate development, most developers fall into the domain from other professions. These are often people in business related (architecture, accounting, law, engineering, construction, urban planning, etc..) Incline that real estate development for personal interest or expediency.

However, training in finance is generally a prerequisite for employment in real estate development firm established. Indeed, since few people and businesses can undertake large building projects with their own capital, the establishment of such projects requires complex financial arrangements,

Financial aspects

Property development is highly dependent on cash.

Real estate is by nature an expensive and illiquid assets. It is expensive to acquire and difficult to sell. In the process of real estate development, the developer must acquire the land, pay the cost of improvements (the hard costs) as well as numerous consultants' fees necessary to complete a project (the soft costs). Since costs are high, that the sale is not instantaneous and that the return on investment is therefore delayed, real estate development is financially risky. Much of the work of a promoter is the management of risk.

-> Site for Marguerite Harbert Gray

Given the large upfront investments, most real estate development projects are financed with a high debt ratio (leverage). This increases the potential profits, but multiplies all the risk on cash. A project will be more profitable than the down payment is minimal and it starts early to generate sufficient cash flow to cover debt service. There will be more risky than building a long time to plan and build, because the perceived market opportunities departure may have evaporated.

Financing real estate projects takes different paths, but most financial arrangements involve the following sources:

The private investor (pension fund, insurance company, net worth individual, partnership, etc.).

The public investor (real estate investment company, tender action, public-private partnership, etc.).

Private debt (debt, mortgage, credit, construction, etc..)

Public debt (redevelopment loans, etc.).

Private grants (a non-profit association, etc.).

Government grants (subsidy to urban renewal, housing credit to low-cost, tax credits, grants for cultural heritage protection, etc.).

Equity (use of cash from other buildings in the sponsor)

Subordination

A successful developer can become very rich, given the profits involved, but the risks are huge, especially when the economy is unstable. The low liquidity of its assets also makes the promoter dependent on external sources of financing that are sometimes very fragile. Illiquidity is a common cause of bankruptcy among developers.

The process of real estate development [edit]

Even if the process of real estate development varies depending on the type of building and the project in question, we can consider the following different steps, in approximate chronological order:

Market research

Site selection / feasibility analysis

The due-diligence / preliminary pro forma

The acquisition of property or a simple call option

The project architecture / detailed pro forma

Obtaining building permits, zoning amendment, permits

The pre-letting

Financing / final pro forma

Construction

Marketing (rental or sale of the property in whole or in units)

Management (when the building is maintained)

-> Site for Marguerite Harbert Gray

In France

Article 1831-1 of the Civil Code describes the role of property developer "common interest mandate by which a person called" developer "obliged to master a book to make for an agreed price , using SSA authority, implementing a program to build one or more buildings and to conduct itself or to proceed, with an agreed payment to all or part of legal, administrative and financial contributing to the same object. " The promoter may be an individual or entity.

The French are big promoters such Nexity, Bouygues Immobilier, Tagerim, Icade Bowfond Marignan Cogedim. They have almost all of their own site, but sites have launched programs in the aggregation of several promoters.

Glossary of Real Estate

Urban Land Institute, a trade association of real estate developers and related professions.

-> Created for Marguerite Harbert Gray