Are you If not, could you forward this site to this person? |

|

|

infomore |

I have done this site especially for Ania Brzezinski |

| |

Ania Brzezinski (former financial analyst with Credit Suisse First Boston)

is wife of Greg Coffey (Australian London-based hedge fund manager).

|

|

|

Sorry for my poor english translation.

Greg Coffey gives up a bonus of $ 250 million

Aged just 36 years, the Australian was the manager Greg Coffey of GLG Partners star, the second largest British hedge fund. In 2007, he received a bonus of $ 75 million ...

This year, he exploded counters by getting a check for $ 300 million.

He managed nearly $ 7 billion, slightly less than 30% of assets of GLG Partners, estimated at 24 billion dollars. The results were impressive. Emerging Markets Fund The fund was last year, the most profitable of GLG Partners, with 51% yield, following a performance of 62% in 2006.

Greg Coffey would have generated in 2007, 60% of "performance fees" of GLG Partners.

Coffey resigned while negotiations were underway with his leadership, which offered him, according to knowledgeable sources, up to 250 million additional shares and stock options.

-> Site for Ania Brzezinski

According to GL, Coffey will remain in the company until October of this year. During this period he will continue to manage GLG funds.

A growing number of investors is about to withdraw their funds totaling some $ 4 billion.

The situation is especially worrying that Soraya Chabarek woman key marketing and head of investor relations is also leaving the fund.

Aged 31, she was remarkably well introduced by investors from the Middle East. It was according to several experts, provided at least a fifth of assets under management, representing 5 billion. The reasons for his departure are unknown, but it is very likely to join Coffey in the creation of a new hedge fund.

Several other key members of staff would be willing to follow Greg Coffey.

To limit the outflow of cash from investors, Noam Gottesman, GLG's boss has imposed a penalty of up to 5% of the amount invested.

Investors can exit the fund without charge, after Greg Coffey will leave the ship, they will have to wait until October 2008.

---

-> Created for Ania Brzezinski

GLG Partners, Inc.. hedge fund is a U.S. subsidiary to 100% of alternative investment funds plc Man.

GLG Partners was founded in September 1995 by a group of former employees of Goldman Sachs. The fund's name is an acronym composed of the first letters of the surname of the three founding partners - Noam Gottesman, Pierre Lagrange and Jonathan Green. These partners have originally received the support of Lehman Brothers.

GLG has offices in Mayfair, London on Park Avenue, New York.

In September 2008, GLG Partners has $ 23 billion of assets under management.

GLG was listed on the NYSE until November 2007. At that time, Lehman had a 11% interest in the fund.

One famous trader Philippe Jabre of GLG is. Another of his famous trader Greg Coffey, has left the fund in November 2008.

On May 17, 2010, the fund announced that Man Group would buy the fund, valuing the fund at $ 1.6 billion, or $ 4.50 per share. Share prices on the NYSE (New York Stock Exchange) rose from $ 2.91 to $ 4.36, up nearly 50% before opening the next day. The acquisition was completed October 14, 2010.

----

-> Site for Ania Brzezinski

Greg Coffey [GLG Partners], the millionaire solo

Known for his genius, Greg Coffey just sit down, voluntarily, on a premium of $ 250 million (162.3 million euros). What fly has stung? The manager has chosen to leave GLG Partners to create his own hedge fund, thereby waiving the premium for this staggering, almost equal to his salary of $ 300 million received for 2007-2008.

Manager of four funds emerging flagship GLG Partners, a Greg Coffey can boast to post record yields (+ 68%) between 2004 and 2007. The Australian has reported nearly half of total fees charged by the British hedge fund in 2007.

His customers do not make a mistake: they have already begun to withdraw their assets in GLG Partners to determine. The financial aspire to greater freedom and discretion. As such, the introduction of GLG in 2007 was a wind blowing media that he would have gone well.

The solo adventure, a popular alternative

According to Le Monde (09/05), the Australian manager evil bear the guardianship of the three principal shareholders of GLG, which together hold 53% of the voting rights of the hedge fund. However, in this type of structure, "the absence of bureaucratic impediments encourages creativity. This area is fertile ground for the blossoming of independent personalities. Greg wanted to be his own boss, "one observer analysis cited by the evening paper.

Greg Coffey is not the first to venture into solo include his former French colleague, Philippe Jabre, the cause of global macro funds in Geneva, or Christopher Horn, who left Perry Parker founded The Children's Investment Management Fund (TCI).

---

-> Created for Ania Brzezinski

Above all, do not stop at the front! At Mayfair, this is part of the culture house. Good manners, decorum and quiet atmosphere of the finest district of London are no longer beyond the delusion magnificent and generous input of red brick houses as small modern buildings. For the floors, where beats the heart of the hedge fund industry, the agitation does not disarm. Appointed to the mob during the financial crisis threatened yesterday to be muzzled by the European Commission and Washington, battered by volatile markets and the reluctance of clients, hedge funds returned to the race.

---

-> Site for Ania Brzezinski

In London, a Coffey and the addition

"I told him, you're like an iceberg. You float around you but all substance. "The iceberg was Greg Coffey, GLG Partners star trader, second British hedge fund. The author of the metaphor ice is one of his more experienced colleagues. Convinced that the diamond was too precious to Coffey GL, then he advised the young Australian to leave the ship. Mid-April, Greg Coffey finally listen to his advice. Leaving on the table a hearty pay (nearly 200 million euros last year) and a bundle of shares, valued today at 313 million euros, Coffey chose to plot its course. Once trained his successor, he will see his name on the door of his own funds. Projected Opening: October.

Tyro. The star of British finance is she being caught in flagrante delicto of arrogance? In any case, the coup was predictable, analysts assign. "When you are told every day that you're the perfect man for the job, you're a great trader, you wonder:" Why not set up my own box? "" Decrypts John Godden, financial consultant specializing in hedge funds. The announcement of the departure of Coffey has yet caused a mini-financial earthquake. May 8, GLG's management announced that its customers had withdrawn $ 1.7 billion (1.1 billion euros) of assets from its coffers since the formalization of the new. And the tornado was also the media, the press became infatuated with this young wolf finance, unusual profile.

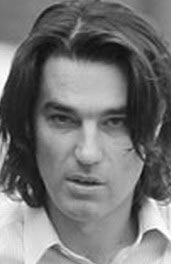

Dark-haired medium-length, preferring jeans and leather jackets to the strict uniform of his peers, Australian 36 year old looks like a leading man in Hollywood. But man has not won its villas on the coast of Australia, his home in London's Chelsea or chalet in Verbier Switzerland, turning thumbs. Coffey, telling his family, working up to twenty hours a day, boarding screens and keyboards on vacation, logs still do not delegating. "He is very paranoid," says his former colleague. He does not trust anyone. "Elsewhere we applaud his extreme intelligence and his great analytical skills. "This enables him to have more often right than wrong," said John Godden yet.

-> Site for Ania Brzezinski

Yet the beginnings of Greg Coffey announced nothing special. Graduate finance at Macquarie University in Sydney, he was hired by GLG for transactions on behalf of traders. Talented, he is forced to emerging markets before landing in late 2005, the management of its own funds. And mayonnaise takes.

Bare. Buoyed by booming markets, it saves tremendous performance. We trust him. Its portfolio is growing by 2 to 7,000,000 dollars and his team of 6-13 people. "Before the introduction of GLG at NYSE in 2007, leaders wanted to display an extraordinary asset growth and have staked everything on their most successful trader. So they inflated, swollen Greg Coffey to bring the title to its maximum value. Today they are paying the price, "said the former colleague of Coffey. To have placed nearly 60% of revenue performance of the company on the shoulders of one man, GLG is found a little frayed. Especially since the Australian should win some large customers representing 4.3 billion dollars (2.75 billion euros) in assets under management, estimated in early May Noam Gottesman, one of the owners of GLG. A slap for the company. "If markets continue to be hesitant, GLG may have trouble paying its fixed costs," said the former colleague of Coffey. "The company has lost two stars traders in two years, but it will still remain. GLC will not collapse like that, "says John Godden, however.

Side of Greg Coffey, the challenge now is to carry his boat alone. "Until then, it has benefited from very good conditions, but never proven in a declining market as one that promises," says his former colleague. Already, the first difficulties lie ahead: since the beginning of the year, the main fund managed by Coffey has conceded a drop of 19%. To stay afloat, the iceberg must learn to navigate in troubled waters.

---

-> Site for Ania Brzezinski

Baraka she justifies the premiums of 250 million?

That's the question I ask myself. The problem with what is presented in the article in Le Monde below is as follows: Mr. Coffey has made more than 68% performance between 2004 and 2007. Well, but how many of his counterparts have been lost or yields far less worthy of bragging? How far can we really believe that its outcome is due to its "head well done"? Take 100 people and made them throw the dice, you will find many who are a minority of the six far more often than average. What are the implications? None.

I'm not a big fan of criticism from those who earn money, rather, how far an employee but he deserves to be paid for work that is perhaps qu'hasardeux be? Before 2004 and after 2008, what returns? If it falls into the red, will he a negative premium? No. He invested where? "Fund Emerging Markets." Enough said. These markets have soared in recent years, 68% did not gloss over increases in indices of these countries. The day the bubble will burst, Mr. Coffey says he will pay the piper, or does he let his clients fully assuming the risks taken?

It is however unlikely that this change in the future because I would not be surprised that in reality customers are certainly very happy anyway. There's just a pest who takes the middle for a star when everything is going well and that disappears when things go wrong.

Nothing personal in these remarks, I still do not know Mr. Coffey or investment strategies / speculation that he has put in place. But these are general thoughts on the subject, which reinforce my idea that you can finance without having to earn a lot of special merit, except at the beginning to join the dance. In view of my actual performance at the beginning, I do not mind being hired by GLG Partners to replace Mr Coffey. When one manages $ 4 billion, the market approach is completely different and I think much more deterministic than when it handled 100 000. Now, I like what is deterministic.

-> Created for Ania Brzezinski